Today the Center received a follow-up email from one of the volunteers at the event:

I volunteered at this event to learn more about the foreclosure process so I could better serve my members. After learning about this event, I strongly encouraged one of my members, who was in foreclosure to attend the event. I was thrilled when she attended, knowing she was already in 4+ months of not paying her mortgage. I am very happy to report that today, I learned, with the assistance of your workshop and being connected to a foreclosure specialist, she was able to qualify for modifying her mortgage and has decreased her monthly payments from $950 to a more manageable $674. The most rewarding part of this, is knowing that she, her husband (both who are disabled) and their 7 children will still have somewhere to live. Thank you for all the hard work you do.

These are the success stories that keep us motivated here at the Center. Our mission is "Succesful Home Ownership"... and we're glad we were a part of this family's success!

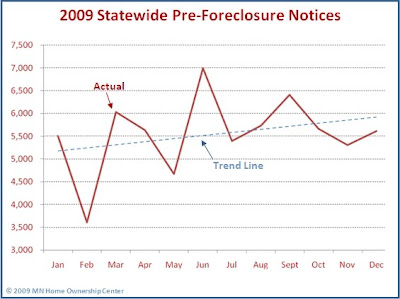

The Center is currently finalizing its Foreclosure Counseling Report for 2009 which we'll be releasing in the coming weeks. The report aggregates thousands of stories like the one above. Stay tuned for more information. (You can subscribe to receive our blog posts via email on the right-hand side of this page, or subscribe to our RSS feed here).

For more information on events, workshops and future trainings, visit the Center's website here.