Over the past few years of the foreclosure crisis in Minnesota, both housing industry professionals and social service agencies have requested an easy-to-use map of service areas covered by the Center's network of foreclosure counseling agencies... that they could print out and keep handy.

Now, the Center has produced a new printable map showing foreclosure counseling services provided by the Homeownership Advisors Network and the geographic or language service area they cover. This map is intended to be a reference tool for professionals as a supplement to the interactive online map.

The map is available for download (print) here.

The same information is also available in an interactive format here.

There are also other resources (including fact sheets, presentations, newsletters and more) available for professionals that may be working with struggling homeowners at the Center's website here.

Foreclosure prevention counseling services are provided free of charge by nonprofit housing counseling agencies working in partnership with the MN Home Ownership Center. Remember: there is no need to pay a private company for these services! For more information an avoiding foreclosure, visit the Center's website.

Tuesday, November 30, 2010

Tuesday, November 23, 2010

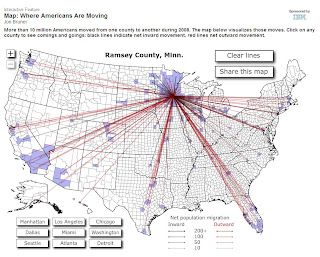

Moving? Where are you going?

I came across a great interactive map from Forbes the other day (yes, they published the map a few months ago... but the information is great). If you click on any county on the map it will show you the inbound and outbound movement for that county... including lines that show where people are moving to and from.

On the map... RED lines show the out-migration* from the county and in-migration* is shown in DARK GREY/Black for households that moved in 2008. While the data is a few years old... there's no reason to think that the trend would have changed too dramatically in the last year and a half.

As an example, here's the migration map for Ramsey County:

If you want to see a REALLY scary picture... click on Detroit (Wayne County, MI).

The interactive map is here.

*NOTE: I've chosen to use the terms out-migration and in-migration instead of Emigration and Immigration... as those terms tend to refer to movement outside/into the country. The movements represented on the Forbes map show the movement of US residents only to and from OTHER US counties.

On the map... RED lines show the out-migration* from the county and in-migration* is shown in DARK GREY/Black for households that moved in 2008. While the data is a few years old... there's no reason to think that the trend would have changed too dramatically in the last year and a half.

As an example, here's the migration map for Ramsey County:

If you want to see a REALLY scary picture... click on Detroit (Wayne County, MI).

The interactive map is here.

*NOTE: I've chosen to use the terms out-migration and in-migration instead of Emigration and Immigration... as those terms tend to refer to movement outside/into the country. The movements represented on the Forbes map show the movement of US residents only to and from OTHER US counties.

Monday, November 22, 2010

Center Board Member Recognized: Top Woman in Finance

The Minnesota Home Ownership Center is proud to publicize the fact that Muffie Gabler, long-time Center board member, has been recognized by Finance and Commerce as one of only 50 “Top Women in Finance” in Minnesota. In addition, Muffie was chosen to join Finance and Commerce’s “Circle of Excellence” as she had previously been honored as a Top Woman in Finance in 2007.

The Top Women in Finance award is given to principals, partners, executive vice presidents, CFOs, CEOs and managing directors at not only financial institutions and lenders but also leaders of businesses small and large throughout Minnesota who have shown innovation, leadership, or some other notable qualities in the area of finance.

In addition to being one of the principal drivers of the creation of the Minnesota Home Ownership Center, Muffie has been an integral part of the Affordable Housing arena in Minnesota and countless affordable housing initiatives and community development projects would never have gotten off the ground without Muffie’s assistance.

Winners were recognized during a dinner and program on November 10th at the Hyatt Regency in Minneapolis. For a complete list of honorees, visit the Finance and Commerce article here.

The Top Women in Finance award is given to principals, partners, executive vice presidents, CFOs, CEOs and managing directors at not only financial institutions and lenders but also leaders of businesses small and large throughout Minnesota who have shown innovation, leadership, or some other notable qualities in the area of finance.

In addition to being one of the principal drivers of the creation of the Minnesota Home Ownership Center, Muffie has been an integral part of the Affordable Housing arena in Minnesota and countless affordable housing initiatives and community development projects would never have gotten off the ground without Muffie’s assistance.

Winners were recognized during a dinner and program on November 10th at the Hyatt Regency in Minneapolis. For a complete list of honorees, visit the Finance and Commerce article here.

Thursday, November 18, 2010

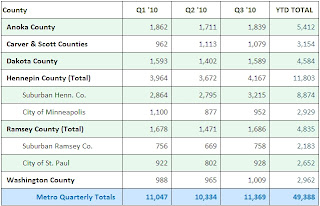

Pre-Foreclosure Notices Continue Unabated

The Minnesota Home Ownership Center has compiled the pre-foreclosure notices received by the statewide network of Housing Counselors through the end of the third quarter (September)... and the upward trend continues!

The most recent quarter (July through September) recorded the second-highest number of pre-foreclosure notices since the MN legislature enacted the notices in the third quarter of 2008. Year-To-Date, the total number of pre-foreclosure notices received has now exceeded 54,000.

Here's the breakdown for the number of pre-foreclosure notices received by members of the Home Ownership Advisors Network in the 7-County Metro Area:

The most recent quarter (July through September) recorded the second-highest number of pre-foreclosure notices since the MN legislature enacted the notices in the third quarter of 2008. Year-To-Date, the total number of pre-foreclosure notices received has now exceeded 54,000.

(Click To Enlarge)

Here's the breakdown for the number of pre-foreclosure notices received by members of the Home Ownership Advisors Network in the 7-County Metro Area:

(Click To Enlarge)

NEW: For the first time since the Center started tracking and publishing the pre-foreclosure notice totals in June of 2009, we are now tracking the running quarterly totals of notices received to see where the trend is heading:

(Click To Embiggen)

This information makes it hard to forecast anything but continued foreclosure activity and continued mortgage difficulties for Minnesota families. As always... if you're struggling with your mortgage payments - or think you might fall behind soon - don't wait! There is a network of non-profit agencies that can help. Contact them today. For additional information about foreclosure prevention in Minnesota - visit the Center's foreclosure prevention resource page here.

Are HAMP Improvements Possible?

On Wednesday, November 17th, MN Senator Franken joined 17 other Senators in sending a letter to Treasury Secretary Timothy Geithner asking for immediate changes to the HAMP program to help homeowners facing foreclosure.

The complete letter is here. (PDF Document)

Here are some of the key steps the Senator(s) recommend implementing in order to improve the HAMP program:

- The creation of the Office of the Homeowner Advocate. This office would focus on assisting homeowners who believe their mortgage servicer is breaking the rules;

- Provisions that would hold servicers accountable;

- Automatically extend permanent mortgage modifications if trial modifications are completed successfully;

- Revise eligibility requirements;

- Ensure that servicers provide homeowners with necessary documentation; and

- Provide homeowners with information as to why they have been denied HAMP modification.

The Minnesota Home Ownership Center applauds any and all efforts to assist struggling homeowners... and welcomes your comments as well!

- Will Senator Franken's suggestions improve the HAMP program?

- What improvements would YOU suggest to improve the HAMP program?

- Do you have other suggestions for helping struggling MN homeowners?

Tuesday, November 9, 2010

Fourth Annual EMHI Summit

The Minnesota Home Ownership Center is pleased to announce that the 2010 Emerging Markets Home Ownership Initiative (EMHI) summit has been scheduled for December 8, 2010 at the Continuing Education and Conference Center on the St. Paul Campus of the University of Minnesota.

The Annual EMHI Summit is a hallmark of the Center’s dedication to the EMHI mission of working to promote homeownership parity. This year's Summit will bring together industry and community stakeholders to develop tools, resources, and best practices aimed at increasing homeownership opportunities for Minnesota’s emerging markets.

The agenda will include:

The Summit is FREE and 3.5 hours of Real Estate CEU credits have been applied for.

REGISTER TODAY: http://emhisummit2010.eventbrite.com

Are you on Twitter? Help Spread The Word! Use Hashtag #EMHI10 (EMHI TEN)

The Annual EMHI Summit is a hallmark of the Center’s dedication to the EMHI mission of working to promote homeownership parity. This year's Summit will bring together industry and community stakeholders to develop tools, resources, and best practices aimed at increasing homeownership opportunities for Minnesota’s emerging markets.

The agenda will include:

- A welcome from MN Home Ownership Center Executive Director Julie Gugin;

- Michael Grover, community affairs manager from the Federal Reserve Bank of Minneapolis, and John Patterson, director of research and evaluation at Minnesota Housing, will provide a comprehensive analysis of the current status of emerging markets homeownership in Minnesota. A traditional part of the EMHI Summit, this presentation will offer thought-provoking insight into the status of emerging markets homeownership and how the current economic environment has impacted effort;

- Representatives from the industry, including Michael A Haley, of Identity Theft Shield, Nancy Hostetler of Open Door Home Loans (Bell Mortgage) and Roxanny Armendariz of Neighborhood Development Alliance will offer practical insights into client credit issues facing members of emerging markets. Discussions will include credit repair and Fair Issac scoring;

- Keynote Speaker: Angela Glover Blackwell (Pending)

Angela Glover Blackwell is a national leader for social justice and equity. She seeks to strenghten America by creating stronger low-income communities and communities of color. A former Sr. vice president at the Rockefeller Foundation, she has appeared on Nightline, PBS's NOW, and is a frequent commentator on public radio's Marketplace and the Tavis Smiley Show. Her articles have appeared in the New York Times, the LA Times and the San Francisco Chronicle.

The Summit is FREE and 3.5 hours of Real Estate CEU credits have been applied for.

REGISTER TODAY: http://emhisummit2010.eventbrite.com

Are you on Twitter? Help Spread The Word! Use Hashtag #EMHI10 (EMHI TEN)

Thursday, November 4, 2010

Foreclosure Data - Another Blow

Lender Processing Services has released their most recent version of the LPS Mortgage Monitor, October 2010 Mortgage Performance Observations which contains an informative series of charts and graphs that show that while delinquent and foreclosed loans had stabilized somewhat at the end of 2009 and into the first half of 2010, new problem loans are once again picking up:

The graph above shows loans that are currently 60 days or more delinquent but that were current just 6 months ago. You can certainly see the upswing that started in the middle of 2010.

The LPS report also has some, albeit limited, information regarding Minnesota. For example, in their table on the Delinquency and Foreclosure Rate, Minnesota ranks 42nd in the nation (that's a good thing!) in percentage of delinquent mortgages:

According to the chart, our delinquency rate is about 34% lower than the national average of 9.27%.

Another chart that contains information about Minnesota shows that the average number of days delinquent for loans that are in foreclosure (time delinquent before foreclosure sale) has increased 85% since 2008, and now overages over a year - 386 days to be exact:

Not only is it taking lenders/servicers longer to foreclose... the number of foreclosures is starting to increase again. This problem is NOT going to go away soon. Thousands of Minnesota families are still struggling every month to make their mortgage payments! If you, or someone you know is struggling... don't wait, contact a member of the Minnesota Home Ownership Center's network of foreclosure counseling agencies TODAY. The sooner you call, the more options you have available!

The graph above shows loans that are currently 60 days or more delinquent but that were current just 6 months ago. You can certainly see the upswing that started in the middle of 2010.

The LPS report also has some, albeit limited, information regarding Minnesota. For example, in their table on the Delinquency and Foreclosure Rate, Minnesota ranks 42nd in the nation (that's a good thing!) in percentage of delinquent mortgages:

Another chart that contains information about Minnesota shows that the average number of days delinquent for loans that are in foreclosure (time delinquent before foreclosure sale) has increased 85% since 2008, and now overages over a year - 386 days to be exact:

Not only is it taking lenders/servicers longer to foreclose... the number of foreclosures is starting to increase again. This problem is NOT going to go away soon. Thousands of Minnesota families are still struggling every month to make their mortgage payments! If you, or someone you know is struggling... don't wait, contact a member of the Minnesota Home Ownership Center's network of foreclosure counseling agencies TODAY. The sooner you call, the more options you have available!

Tuesday, November 2, 2010

Vote Again!

No... the Minnesota Home Ownership Center is not advocating voter fraud! :-)

We want you to vote on the consumer handout that we plan to produce for our Look Before You Leap campaign.

“Look Before You Leap” is a statewide public education campaign seeking to raise public awareness about the booming foreclosure rescue scam industry and its dangerous implications for struggling and unsuspecting home owners, and to connect struggling home owners with the Center’s network of FREE and trustworthy foreclosure counselors.

The piece we are designing will be used in mailings, handouts, counter displays, etc... and we hope to make the piece as attractive as possible so that struggling homeowners see the piece and respond.

Here are the two options:

(Click To Enlarge)

Would you take please take 30 seconds to respond to a quick on-line survey about the piece? 4 questions... 30 seconds... SURVEY HERE

You can also leave feedback in the comments! We'll be compiling this information through Friday, November 5th. THANKS!

We want you to vote on the consumer handout that we plan to produce for our Look Before You Leap campaign.

“Look Before You Leap” is a statewide public education campaign seeking to raise public awareness about the booming foreclosure rescue scam industry and its dangerous implications for struggling and unsuspecting home owners, and to connect struggling home owners with the Center’s network of FREE and trustworthy foreclosure counselors.

The piece we are designing will be used in mailings, handouts, counter displays, etc... and we hope to make the piece as attractive as possible so that struggling homeowners see the piece and respond.

Here are the two options:

(Click To Enlarge)

Would you take please take 30 seconds to respond to a quick on-line survey about the piece? 4 questions... 30 seconds... SURVEY HERE

You can also leave feedback in the comments! We'll be compiling this information through Friday, November 5th. THANKS!

Subscribe to:

Posts (Atom)