Tuesday, June 30, 2009

Mid Year Foreclosure Counseling Numbers

In 2008, the Minnesota Home Ownership Center's network of foreclosure prevention specialists assisted a record number of struggling Minnesota Homeowners. As reported previously, the network assisted over 11,000 families.

HOWEVER, In 2009, if current numbers hold through the end of the year, the network should assist over 15,000 homeowners - - A STAGGERING 27% increase over 2008!

Through May 31, 2009, specialists had counseled 7,537 families!

Even with the increased difficulties facing homeowners due to the current economic climate, and the increased number of homeowners seeking assistance, the network of specialists are still doing AMAZING things for their clients. Of the cases that have been 'resolved' (how our data tracking software labels homeowners where the outcome of their situation is known or consumer has decided to no longer work with the counselor)... the results are nothing short of spectacular:

Percent of resolved cases where foreclosure was averted: 63.66%

Percent of resolved cases where foreclosure was not averted: 22.50%

Percent of resolved cases where outcome is unknown: 13.84%

Of those cases where foreclosure was averted... How was the homeowner able to avoid foreclosure? Through May 31:

By bringing payments current .......... 40%

By modifying the loan .......... 25%

By obtaining a Forbearance Agreement .......... 17%

By Short sale .......... 6%

By filing Bankruptcy.......... 3%

By other means .......... 8%

There are a few caveats with the number presented here... while the actual number of clients counseled year-to-date is a definitive number (7,537) the number of resolved cases will change over time, which will affect (probably downward) the percentage of foreclosures averted.

All data in this post should be considered 'draft information' until our year-end report that should be available in the first quarter of 2010.

Congratulations to our statewide network of counselors. They continue to work incredibly hard on behalf of Minnesota homeowners!

Monday, June 29, 2009

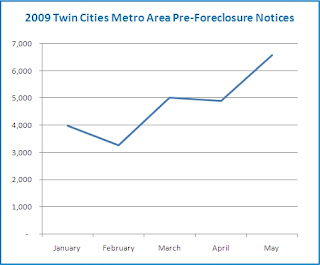

Twin Cities Pre-Foreclosure Notices

Minnesota State law (MN Statute 580.021) requires that the foreclosing party provide information regarding foreclosure prevention counseling services to the mortgager (homeowner) AND provide the homeowner’s name, address, and most recent known telephone number to an approved foreclosure prevention counseling agency - BEFORE filing the notice of pendency.

Once The Minnesota Home Ownership Center's network of foreclosure prevention agencies, recieves notification from the lender/servicer/homeowners association, they then contact the homeowner, and track the number of notifications received during the month in their monthly reporting to the Center.

The Center has decided to publish here on the blog the 7-County metro area numbers of pre-foreclosure notices that the network agencies have received. This will allow everyone to see upcoming trends in foreclosure numbers - as well as highlight the outstanding job that our network partners do to reach as many homeowners as possible.

The latest numbers do not show a slowdown in the number of pre-foreclosure notifications - and actually show that the trend-line continues to increase:

Wednesday, June 24, 2009

La Mera Buena - Summer Radio Campaign

The message, read by on-air personality Mike Castillo, lets Spanish-speaking homeowners that may be struggling with their house payments about working the existence of FREE, non-profit foreclosure prevention services and warns them about working with for-profit agents that may not have their best interest in mind.

The text of the message (translated to English):

If you think you’re in danger of, or are already facing, foreclosure… you’re not alone. In Minnesota, there are services available to receive advice and assistance – FREE OF CHARGE – to help keep you from losing your home. Unfortunately, there are people who only want to take advantage of you in your situation, and they can actually make things even worse. If you need assistance, contact the MN Home Ownership Center at 651-659-9336 or MN Housing at 651-296-7975. And remember: Don’t let yourself be fooled. This message is sponsored by the MN Housing Finance Agency and the MN Home Ownership Center.

The message, which will run about 80 times over the summer, has already increased the volume of calls to the Center requesting information about foreclosure services.

You can hear the spot (MP3 Format), here.

American's Attitudes Towards Homeownership is Changing

The National Foundation for Credit Counseling (NFCC) has released the results of a recent telephone survey regarding current consumer attitudes towards housing and homeownership in America.

The results show that attitudes towards homeownership have shifted in the past few years. One of the staggering findings is that currently, over 50% of those surveyed no longer believe that homeownership is a realistic way to build wealth - - even though homeownership is the NUMBER ONE wealth building vehicle for low to moderate income Americans.

The findings of the survey – which took place between May 29th and June 1st of this year - also include:

- Almost one-third of those surveyed, or roughly 72 million people, do not think they will ever be able to afford to buy a home;

- Forty-two percent of those who once purchased a home, but no longer own it, do not think they’ll ever be able to afford to buy another one;

There's lots of other valuable information regarding consumer attitudes towards homeownership... be sure to read the full report. (Scroll down, report begins AFTER the press release).

And now here’s an important piece for future homeowners:

- Seventy-four percent of those who have never purchased a home felt that they could benefit from first-time homebuyer education from a professional.

THINK HOME STRETCH! If you’re thinking of purchasing your first home – or have recently gone through foreclosure and would like to investigate the possibility of purchasing another home in the future – the statewide network of Home Stretch Educators and Counselors are here to help! They’ll provide you with non-biased, honest answers to your homeownership questions. From teaching you the steps to become a SUCCESFUL homeowner to seeing if you qualify for any of the first-time buyer programs, down-payment assistance programs or foreclosure recovery programs… your local Home Stretch provider has only one goal in mind – helping YOU become a SUCCESFUL homeowner. For more information, click here.

Thursday, June 18, 2009

Brookings Institution: TC Metro 8th highest REO

The Brookings Institution has released a report that states the Twin Cities Metro area has the EIGHTH HIGHEST percentage of Lender Owned (REO) properties in the COUNTRY.

The report states that the Twin Cities Metro (Referred to in the report as Minneapolis/St. Paul/Bloomington) has 7.63 REO properties per 1,000 mortgageable properties.

The interactive chart showing the REO properties in the largest 100 metro areas in the U.S. is here.

The links to the underlying data are broken, so there's no way to show where or how they've collected this data... so I toss this question out to our local Real Estate professionals: Do the numbers seem legitimate?

Here's some thoughts - - if it turns out the numbers are legit:

1. There will be more opportunities than ever for first-time buyers to purchase an affordable home in the Metro - although first-time buyers should be aware of the possible pitfalls involved in purchasing a previously foreclosed home. Before purchasing ANY home, a first-time buyer should speak with a Home Stretch specialist to make sure they understand the homebuying process.

2. House prices in the Metro will continue to have downward pressure as these properties make their way through the system.

3. There will be continued financial pressures on our local cities in relation to these properties: code enforcement, monitoring vacant properties, downward pressure on property valuations leading to lower tax receipts, etc.

ANY OTHERS? Feel free to share your thoughts in the comments.

MPR: Foreclosures Fall First Quarter 2009

Yesterday on MPR Annie Baxter highlighted the HousingLink data that shows that foreclosures have dropped slightly in the first quarter of 2009 in Minnesota. You can read the article here.

Center staff were quoted once again in this article.

We've received a number of emails from our readers... apparently too shy to reply in the comments... about where they see foreclosures heading in Minnesota. (See the question we posed in yesterdays post: Star Tribune: Foreclosure Trend Question).

Most agree that we'll see similar numbers to 2008 - - but that the DISTRIBUTION of the foreclosures will be different. Most feel we'll see more suburban and greater Minnesota foreclosures as the economy impacts those areas more heavily. What say you? Feel free to respond in the comments.

Wednesday, June 17, 2009

Star Tribune: Foreclosure Trend Question

The full article, "State home foreclosures drop: Trend or just a blip?" is available on-line, here.

The question is a great one. It's true that there has been a decline in the number of foreclosures when we track year-over-year numbers between 2008 and 2009. Is this a sign that things are getting better?

Noone has a crystal ball that can accurately predict where things are going... and Steve Brandt's article certainly reflects that.

While things may not be as bad in 2009 as they were in 2008, here are some thoughts on why we are probably not nearing the end of the foreclosure issue in Minnesota quite yet:

1. The Center's 2008 counseling data shows that OVER 50% of the homeowners that sought mortgage assistance in 2008 did so due to a job loss or a loss of income. Given that the current economic climate is certainly not showing any signs of a quick recovery, the number of homeowners affected by the downturn, and in turn struggling with their mortgage, will probably continue unabated.

2. Data has shown that there is a HUGE number of ALT-A and even Prime mortgages whose introductory rates are set to recast in late 2009, 2010 and even 2011. (Image below show NATIONAL numbers - the Federal Reserve Bank of Minneapolis has some Minnesota-specific numbers here.). Given that the current housing market won't allow many of these homeowners to refinance out of these products, we will probably see another wave of foreclures - - this time focused in the suburban and ex-urban areas of the Twin Cities metro - where many of these loans were originated.

Any other thoughts? Feel free to leave a comment if you have other reasons that may affect Minnesota's foreclosure numbers in 2009 - - or even if you totally disagree with the reasons posted here.

If you're struggling with your mortgage payments, DON'T WAIT, click here for help.

MPR: Foreclosure is Even Harder for Single Women

As part of Minnesota Public Radio's ongoing series on foreclosures in Minnesota, Annie Baxter has broadcast a piece on the unique challenges facing single-female headed households facing foreclosure.

The piece, which first aired on Tuesday, June 16th and is now available online, includes some stats (graphic) on homebuyers, an interview with Ed Nelson from the Center, as well as a client that was assisted by the Neighborhood Development Alliance (NeDA) in St. Paul. NeDA is a member of the Center's network of foreclosure prevention providers.

The on-line article, including a link to the recorded broadcast, is here.

Knowing what to do when facing foreclosure - or struggling with mortgage payments - can be confusing whether you're a family or a single-parent. In Minnesota, there is a statewide network of FREE, NON-BIASED, non-profit organizations, like the Neighborhood Development Alliance, that can assist you. If you're struggling with mortgage payments, click here to find the agency that's closest to you and will best be able to help.

Home Stretch and the Neighborhood Stabilization Plan (NSP)

As many of our partner organizations are working with clients that will be taking advantage of the NSP program to assist them with their home purchase, I thought I'd forward along some information that might help clarify some of the misconceptions regarding the education requirement of the NSP program:

Participants in the Neighborhood Stabilization Program (NSP) are required to complete 8 hours of pre-purchase education and counseling from a HUD-Approved Counseling Agency. While Home Stretch is the state of Minnesota's premiere pre-purchase education program... NOT all Home Stretch providers are approved HUD counseling agencies.

If you are a homeowner looking to use the NSP dollars, or if you're a real-estate professional working with future homeowners that will be using the NSP program... please check the Center's website here for a complete list of the HUD-Approved Counseling Agencies, as well as how to tell if a given Home Stretch workshop is NSP Approved. This will save you or your clients the hassle of having to RE-TAKE the workshop. (Yes, sadly, it has happened).

Looking to the future... the The Center has applied for a waiver that would allow additional Home Stretch providers to be "Approved" NSP Education providers. The Center continues to work with MN Housing on this waiver and meeting the conditions set forth by HUD. EVEN if the waiver is approved, based on the conditions of established by HUD not all Home Stretch providers will be approved, and, in addition, there is no guarantee the waiver will be approved.

Until further notice from the Center, or MN Housing, only the agencies listed at the Center's website here meet the NSP education/counseling requirement.

Monday, June 15, 2009

Coming Home: Strib Highlights Home Stretch

An article by Lynn Underwood in this past Sunday's Star Tribune covered the story of the Roggenbuck family, who purchased a previously-foreclosed home through Bremer Bank using Native American Homeownership Initiative funds and assistance from the Minnesota Housing Finance Agency - and the knowledge they received from taking the Home Stretch workshop.

The complete article is here.

Would you like to know more about the Home Stretch program? For a complete overview as well as additional information about the families who have participated, the Center has made the 2007-2008 Home Stretch Program Report available on its website here.

If you are a homeowner interested in purchasing your first home in Minnesota... Home Stretch is the place to start! Learn - start to finish - everything that is involved in becoming a homeowner at the Home Stretch Workshop. Then see if you qualify for any down-payment assistance programs, first-time buyer programs or community recovery (foreclosure recovery) programs - like the Neighborhood Stabilization Program - by speaking with a Home Stretch Counselor. For more information, click here.

Minnesota's New Foreclosure Postponement Law

Effective today, June 15, 2009 Minnesota state law allows homeowners that have fallen behind on their mortgage payments to delay, or postpone, the Foreclosure Sale (also known as the “Sheriff’s Sale” or "Sheriff's Auction") of their home by five months.

If a homeowner chooses to do so, postponing the Foreclosure Sale would give them five more months to bring their mortgage current. The tradeoff, however, is that it also reduces the redemption period to just five weeks. (Standard MN redemption period - the amount of time AFTER a Sheriff's Sale that the homeowner can remain in the property and attempt to redeem it - is 6 months).

The Minnesota Home Ownership Center has created a fact sheet and sample affidavit to assist homeowners that might be interested in postponing their Foreclosure Sale. The FAQ covers the basic steps that need to be taken in order to postpone the sale.

The FAQ about Minnesota's Foreclosure Postponement Law and sample affidavit are available here.

Here’s a disclaimer regarding this information: the FAQ is provided as a service of the Minnesota Home Ownership Center and is not presented as legal advice. Homeowners should consult a competent legal professional for advice specific to their situation before deciding if postponement is right for them.

In addition, before deciding to delay or postpone a Foreclosure Sale, homeowners should consult with a foreclosure specialist to understand the pros and cons of a postponement, and to see if there are any other resources or assistance available to them. To find their local foreclosure specialist, homeowners should click here.

Thursday, June 11, 2009

Pre-Purchase Education Training Opportunity

The Minnesota Home Ownership Center will be offering NeighborWorks® Home Buyer Education Methods: Training the Trainer (HO229) for housing professionals that conduct Home Stretch workshops in Minnesota, or other professionals interested in pre-purchase education. The training is designed to:

- Teach participants how to deliver a comprehensive homebuyer education workshop in a group setting;

- Use the best materials and methods to train homebuyers to get a mortgage loan, improve their budget and credit profile and shop for a home;

- Improve facilitation skills and deliver an interactive training based on adult education methods.

This training is open to the public however priority registration will be given to Home Stretch providers.

The training will be offered at Bremer Service Center in Lake Elmo, MN

Cost: $430 (Plus any accomodations)

To Register: http://trainingthetrainer2009.eventbrite.com

PLEASE NOTE: While this training is required for all professionals that offer the Home Stretch workshop in Minnesota, completion of this training in NO WAY certifies you to be a Home Stretch provider. There is an application processs that must be completed before being able to offer Home Stretch workshops. For more information about the training, or becoming a Home Stretch provider, please contact: Brooke Walker at brooke@hocmn.org or 651-659-9336 x 106

Center Partners Win Several Awards

Hennepin County:

Hennepin County has been honored by the National Association of Counties (NaCO) with a 2009 NaCO Achievement Award for the County's Foreclosure Prevention and Response Program. Not only was the County an award winner, but they were declared "Best In Category" for 2009. Congratulations to Jeff Strand (Administrative Supervisor Foreclosure Prevention & Response Program Tax-Forfeit & Property Revenue Program Taxpayer Services [That's quite a title, Jeff!]) for the award.

Hennepin County has worked with the Center at a number of levels from marketing and outreach to direct homeowner assistance through workshops at the County Libraries. For more information about upcoming workshops at the Hennepin County Libraries, click here.

If you live in Hennepin County and are having difficulty with a foreclosure or mortgage payments, click here.

City of St. Paul:

The City of St. Paul Planning and Economic Development Department - who not only partners with the Center on foreclosure prevention outreach efforts - but also oversees the foreclosure counseling program for City of St. Paul homeowners, was recently honored by the Minnesota Association of Government Communicators, winning TWO separate awards in the 2009 Northern Lights Contest.

Award of Excellence Presented For: Best Use of a Promotional Product

Don't Lose Your Home to Foreclosure

and

Award of Excellence Presented For Visual Design - Themes

Don't Lose Your Home to Foreclosure

Congratulations to Cecile Bedor, Michelle Vojacek and the entire St. Paul PED team for their award-winning, innovative approach to foreclosure outreach using magnetic bumper stickers on City-Owned vehicles.

If you live in the City of St. Paul, and are facing foreclosure or having difficulty with your mortgage payments, click here.

Wednesday, June 10, 2009

Renters in Foreclosure: KARE-11 Report

As we've posted about before (Here and Here, for example)... some of the people that are being affected by the current foreclosure situation in Minnesota have NEVER bought a home. Over and over again the Center hears about RENTERS that are affected by the fact that the property they are renting has fallen into foreclosure.

KARE-11 News has featured the story of a Minnesota renter that was forced to move due to the fact that her landlord had fallen into foreclosure.

Many times renters in a foreclosure situation don’t know where to turn for quality, trustworthy information. In the KARE-11 report, Matt Eichenlaub, Attorney for HomeLine and a friend of the Center, dispels some of the rumors regarding renters rights in a foreclosure situation.

There is additional information for renters, including how to contact HomeLine, at the Center’s website here.

If above embedded video isn't working... you can visit the KARE-11 site, here.

Friday, June 5, 2009

HopeNow - 800 MN Families Served!

Yesterday's HopeNow Borrower Workshop at the St. Paul RiverCentre was a complete success!

Dozens of volunteers worked tirelessly to make sure everything ran smoothly... nearly 30 non-profit foreclosure specialists met with hundreds of homeowners, dozens of social service agencies and assistance programs shared their programs with homeowners, and

Most importantly:

800 Minnesota Families were served!

We'll be following up in the next few days with testimonials/quotes, photos from the event - and information an the families served.

Even though the event has passed, the Center is leaving the event information on our website for a few days. Feel free to check out the list of participants, here.

Thursday, June 4, 2009

TODAY IS THE DAY - HopeNow Workshop In St. Paul

This is a short post to remind all our readers / subscribers / email recipients that the HopeNow Borrower Workshop is TODAY!

June 4, 2009 2:00 – 8:00 p.m.

(Open House - come at any time!)

St. Paul RiverCentre

175 West Kellogg Boulevard

St. Paul, MN 55102

The event is FREE - and a reduced parking rate of only $3.00 is available at the Smith Avenue Transit CenterParking Ramp, located at intersection of Smith & Kellogg.

For more information, including a complete listing of all lenders/servicers that are participating and a list of additional services offered at the event, click here.

Can't make the event today... but are still struggling with mortgage payments? Click here.

Wednesday, June 3, 2009

Causes of Mortgage Default

Their findings? Here's the highlight:

The Fed paper estimates that a 1-percentage-point increase in the unemployment rate boosts the chance of a 90-day delinquency by 10%-20%, and a 10-percentage point fall in house prices raises the probability of a default by more than half. A 10-percentage-point jump in the debt-to-income ratio, meanwhile, increases the chance of a 90-day delinquency by 7%-11%.

This actually tracks closely with the data that the MN Home Ownership Center highlighted in its 2008 Foreclosure Program Report:

Half of home owners reported facing either a decline in income (35%) or job loss

(15%) as a primary driver in their mortgage struggles.

Here's what the Center found when it analized the data from the statewide network of counselors:

Increase in loan payment was only cited 9% of the time as the reason for default!

No matter what the reason you, or someone you know may be falling behind... HELP IS AVAILABLE. For more information, click here.

Hat Tip: BubbleMeter

Tuesday, June 2, 2009

HopeNow Event - Partnerships are the key

As frequent readers of this blog know, The Minnesota Home Ownership Center and Federal Reserve Bank of Minneapolis are joining with two national organizations, HOPE NOW and NeighborWorks America, to bring a large-scale foreclosure prevention workshop to the Twin Cities later this week. The event, which is free and open to the public, will be held on Thursday, June 4th from 2:00 - 8:00 pm at the St. Paul RiverCentre.

This is the first time the Center has partnered with the HopeNow Alliance, the Fed and NeighborWorks America to bring a large-scale foreclosure prevention workshop to the Minneapolis/St. Paul metro area.

The Center believes that MN Homeowners are best served through collaborative efforts like the HopeNow workshop - and the great working relationship our counselors have with local, regional and national lenders/servicers. Our 2008 Foreclosure Counseling report shows that through our collaborative efforts, thousands of Minnesota families where able to avoid foreclosure. To view this report, click here.

Many times lenders are seen as the bad guys - just waiting to get their hands on 'the little guys' home... (Click here for an extreme example) and don't receive enough good press about their efforts for working collaboratively with organizations like the Minnesota Home Ownership Center. The Center applauds all efforts undertaken for the good of Minnesota homeowners! For a complete list of the lenders and servicers that will be attending the event on Thursday... click here.

For more information about the HopeNow Borrower Workshop - including the complete list of additional services that will be available at the workshop, click here.